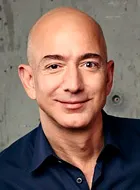

Warren Buffett is an American business magnate and investor. He is the chairman and CEO of Berkshire Hathaway, and is considered one of the most successful investors of all time. Buffett is known for his adherence to the value investing philosophy and his remarkably humble lifestyle despite his immense wealth.

How to Win Friends and Influence People

Warren BuffettsourceIn my office, you will not see the degree I have from the University of Nebraska, or the master’s degree I have from Columbia University, but you’ll see the certificate I got from the Dale Carnegie course

Shoe Dog

Warren BuffettsourceThe best book I read last year

The Intelligent Investor

Warren BuffettsourcePicking up that book was one of the luckiest moments in my life

A Short History of Nearly Everything

The Moment of Lift

Warren BuffettsourceI think this is one of the best books I've ever read

The Little Book of Common Sense Investing

Warren BuffettsourceThere are a few investment managers, of course, who are very good — though in the short run, it’s difficult to determine whether a great record is due to luck or talent. Rather than listening to their siren songs, investors — large and small — should instead read The Little Book of Common Sense Investing

Business Adventures

Warren BuffettsourceBill Gates: Not long after I first met Warren Buffett back in 1991, I asked him to recommend his favorite business book. He didn’t miss a beat: “It’s Business Adventures by John Brooks,” he said

The Most Important Thing

Common Stocks and Uncommon Profits

Warren BuffettsourceA thorough understanding of the business, obtained by using Phil's techniques...enables one to make intelligent investment commitments

Common Stocks and Uncommon Profits

Warren BuffettsourceA thorough understanding of the business, obtained by using Phil's techniques...enables one to make intelligent investment commitments

The Outsiders

Warren BuffettsourceThe Outsiders is an outstanding book about CEOs who excelled at capital allocation

Security Analysis

Warren BuffettsourceA road map for investing that I have now been following for 57 years

Personal History

Stress Test

Warren Buffett's Ground Rules

Poor Charlie’s Almanack

Warren BuffettsourceJust buy a copy and carry it around; it will make you look urbane and erudite