Michael J. Burry is an American investor apart from being a hedge fund manager and he is famed for his foreseeing of the 2000s house bubble by dint of which he profited all the more when it busted. He is a hedge fund manager and founder of Scion Capital.

15 books on the list

The Intelligent Investor

Michael Burrysource6 books every investor should read

This is an extremely essential guide for all those who are interested in effective investment. It stresses the importance of value investing – an investment approach that is centered around the acquisition of stocks that are undervalued but are more likely to promise future growth. Based on his extensive experience, the author advises one to approach everything with discipline, to be independent of all market trends, and to differentiate between investing and speculating. It teaches on financial security and prosperity in the stock market by urging one to analyze thoroughly and be patient. With such timeless advice, it only remains a required reading for both beginners and seasoned investors out to navigate the complexities of the investment world.

Atlas Shrugged

A world where bit by bit everything in life is more and more controlled by the government, and the most brilliant minds in industry and science are vanishing. The mystery unravels through the eyes of Dagny Taggart, a railroad executive in continuous struggle to keep afloat the business, which seems to drown in such chaotic elements. The issues that are taken up by the plot include individualism, freedom, and the human mind in the course of existence. Who is John Galt? That was the question the whole world found on its lips as it collapsed under the load of regulations and the mediocrity this breeding ground fostered. This becomes the key to the discovery of a mass exodus of the world's innovators, and the road to a new way of life.

All the Devils Are Here

Recommended by: Michael Burry

Weaving a mystery deep within the darkness of evil and the effects of past acts on the present, it is a powerful, intricate mystery that examines many layers of human nature and how complicated life's choices can prove and their unforeseen consequences.

Guns, Germs, and Steel

It is a seminal book about inquiry into the way the modern world came to be shaped by environmental and geographic factors. The author suggests that the fates of societies were determined by the distribution of guns, germs, and steel among them. The book discusses why some civilizations had rapid development and dominance over others, due not to racial or genetic superiority but access to key resources that defined success. The book, in a sense, challenges the prevailing notion of European hegemony in great detail along the human history and tries to articulate a new understanding of development that covers the planet.

Common Stocks and Uncommon Profits

Learn investment approaches to concentrate on discovering growth stocks with potential of bringing in high returns. This compendium of writing presents guidelines on how to determine companies with superior chances for growth in future through an analysis of the way management practices, financial health and competitive benefit are put to use. It thus points out the fact that the qualitative aspects like research and development, profit margins, and market efficiency also play their part and hence should not be overlooked for the interest in short-term market trends. It provides a long-term perspective to the readers' investment in building a portfolio of high-quality stocks, which can provide superior returns over time, illustrated by the principles through real-world examples.

When Genius Failed

Recommended by: Michael Burry

It narrates the drama of rising and falling that happened to Long-Tjsont Capital Management in a tragic lesson in financial hubris. Offers a peek into chinks in the financial system, setting examples as to how even the smartest of people could get blindsided by forces in the market.

University of Berkshire Hathaway

Recommended by: Michael Burry

Uncovering insights about the investment wisdom of Warren Buffett and Charlie Munger from a curation of lessons garnered from the annual Berkshire Hathaway shareholders meetings. This guide goes on to provide a rare peek into their strategies, philosophies, and decisions that offer readers practical advice on value investing, business evaluation, and wealth management. It is a distillation of decades of financial expertise into understandable concepts, an illustration of how patience, discipline and understanding of the true sources of investment returns lead to great success in investing. Relevant for the experienced investor and for the beginner, The Berkshire Hathaway Way captures perfectly just what has made Berkshire Hathaway a model of superlative behavior in the investment world.

Security Analysis

These range from the techniques of value investing, through which undervalued stocks with great long-term potential are found. This is a landmark treatise providing details about analysis methods for stocks and bonds and exemplifying the importance of examining a company's financial statements, understanding a company's operations, and assessing a company's future earnings prospects. This is a must-read for every serious investor, given the way it teaches safety of principal and adequate returns and how to develop a disciplined approach to investments—so as to avert common pitfalls, and while at it, developing a sound investment philosophy based on fundamental analysis.

You Can Be a Stock Market Genius

Recommended by: Michael Burry

Demonstrate how the investor can go the extra mile in search of the "hidden" opportunities that most people will overlook, with a stress on both research and contrarian approaches towards finding undervalued assets in the market place.

Against the Gods

Recommended by: Michael Burry

It chronicles a history of risk, getting into the specifics with great breakthroughs that change decision-making. It makes one go on a journey through probability and how it influences our understanding of risk and running finances.

Buffettology

Recommended by: Michael Burry

Explains in layman language an investment strategy used by Warren Buffett, letting one in on how he goes about evaluating companies and makes investment decisions. It provides a point-by-point yet detailed look at the principles of value investing and how they can be used.

Why Stocks Go Up and Down

Recommended by: Michael Burry

A book that clearly explains what an investment, bond, or stock is and the factors that determine its value. For all levels—new and seasoned investors, it demystifies concepts about financial statements and investment strategies.

Value Investing Made Easy

Recommended by: Michael Burry

In what is a very good book on the market, demystifying the principles of value investing, value forward offers a clear, accessible route to identifying undervalued stocks and making informed, long-term investment decisions. It summarises the strategies of some of the greatest investment legends such as Warren Buffett and explains complex financial concepts with practical advice and simple examples that any reader who wants to know how to navigate the stock market successfully and achieve financial growth can follow.

The Rediscovered Benjamin Graham

Recommended by: Michael Burry

Presents Benjamin Graham's investment wisdom, noting in particular the principles that value investing is based on, which are timeless in nature. This book elaborates on the precepts and the tenets on which Graham held his views on stock-market investing, shedding light on how those perspectives continue to hold true in today's financial environment.

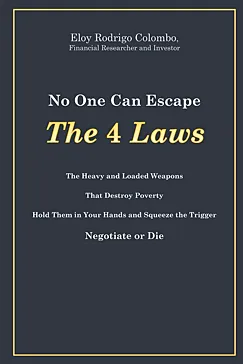

No One Can Escape the 4 Laws

Recommended by: Michael Burry

Lay out the master laws of both personal and professional success. Offers readers thrilling analysis on these laws and a map on how to flow with each, joining them so they win at multiple life's games.